Industrial manufacturing deal volume declined in 2022 due to uncertainty from global economic and market influences. Rising cost of capital, inflation, geopolitical uncertainty, increased freight costs, and volatile raw material prices and availability is likely to continue to challenge M&A in 2023. As a result of these pressures, M&A activity for manufacturing companies has been driven by corporations and private equity portfolio companies seeking strategic expansion of platforms and programs, and stabilizing supply chains. Moreover, the need for speed in business transformation, which is accelerating thanks to technological advances and the evolving economy, will keep dealmaking front and center. No matter if changing supply chains, adopting new go-to-market approaches, or adding capabilities, the market is demanding. The quickest way to transform a business is through M&A, divestitures, or other deals.

Notwithstanding today’s headwinds, deal volume is still higher than in 2019, before COVID. While rising interest rates are making debt service more costly, rates are still far lower than historical highs. Companies with healthy balance sheets and a strong strategic vision can use deals as a path to business transformation and increased value. Note, growth alone is not a sufficient corporate strategic objective in a rapidly changing environment. The right combination of making acquisitions and divestitures to reinvest can drive a return on capital even in an environment with higher capital cost and inflation. History tells us that winners don’t pause M&A during downturns, rather they take advantage of opportunities to reshape their companies and positions with their broader industries. Companies that make acquisitions during downturns tend to see higher shareholder returns in the period that follows. Unlike past M&A down cycles, such as after the dot-com bubble of the early 2000s and the Great Recession of 2008-2009, it is likely the 2022 reduction in activity will be shorter lived. U.S. M&A activity in 1H 2023 is currently reflecting lower levels albeit that is compared to the record levels experienced in 2021-2022. While it is too early to make a conclusive determination on the overall direction of M&A activity for 2H 2023, the growth in the private equity industry, sophistication of corporate clients, and overall strength of corporate balance sheets and earnings should result in increased M&A activity in 2023 and beyond.

Taureau Group is working with a number of manufacturing companies in various capacities – looking to sell, recapitalize and make acquisitions. When considering the unique needs facing the manufacturing industry, it is important now more than ever to find the best partner who understands your company’s objectives, from developing ways to increase efficiency, expanding product/service offerings, shoring up supply chains, exploiting growth opportunities and finding skilled employees. Taureau Group will provide creative, unconflicted solutions and strategies with unequivocal attention to your company’s M&A goals and success.

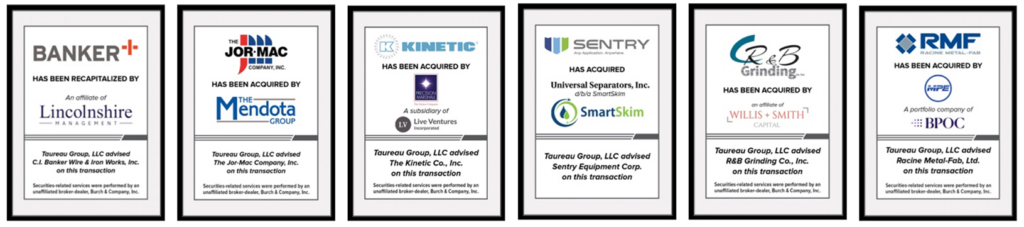

Below is a sampling of recent manufacturing industry transactions proudly completed by Taureau Group:

About Taureau Group:

Taureau Group is an independent investment bank providing merger and acquisition services to lower middle market companies throughout the world. Our global network leverages the market reach that enables us to achieve outstanding results for our clients. Taureau Group’s award-winning team combines the capabilities of large, bulge-bracket investment banks with the service and responsiveness of a boutique firm.

Principals of Taureau Group have over 200 years of collective M&A experience and have successfully completed hundreds of transactions for a wide array of clients in virtually every industry. Transactions typically involve closely held, family-owned businesses, or private equity platforms with transaction values ranging from $15 million to $250 million.

Our experienced team is available to discuss your specific situation or objectives.

Contact us at (414) 465-5555 or email Andrew Sannes, Managing Director, at [email protected].

National Clients. Global Results.

Securities offered through Burch & Company, Inc., member FINRA / SiPC. Burch & Company and Taureau Group, LLC are not affiliated entities. Principals of Taureau Group are registered investment banking representatives with Burch & Company. Any testimonials presented herein do not guarantee future performance success.