Wisconsin Department of Revenue (DOR) Secretary, Peter Barca, and John Koskinen, Chief Economist for the Wisconsin Department of Revenue spoke to WMEP Manufacturing Solutions team members about “The Economy and Its Impact on Wisconsin Manufacturing” on Monday, September 12th at UW Oshkosh at Fond du Lac’s Prairie Theatre.

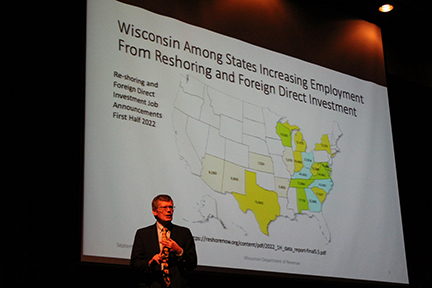

Secretary Barca’s presentation highlighted the strength of The Wisconsin Economy, as well as the attractiveness of the state to companies and workers, while Chief Economist Koskinen explored the performance and outlook of the Wisconsin Manufacturing economy.

Barca shared that the tax burden on Wisconsin citizens has declined significantly with $2 billion in individual tax relief occurring over the biennium. He noted that 2.4 million Wisconsin tax filers will receive tax relief. Wisconsin is currently ranked 23rd in total state and local taxes as a percentage of personal income, down significantly from its 4th place ranking in 1999.

He noted, “With all of the tax cuts Governor Evers signed into law, 86% of Wisconsin taxpayers will see a 15% income tax cut.”

Barca added that Wisconsin had returned to 2/3 funding for education in the state, a key Evers priority, which translates to additional property tax relief for homeowners.

Secretary Barca explained that the state had also benefitted from federal recovery driven funds. By being ready to execute relief projects the state added over $100 million to the state economy from surplus funds from other states that did not have ready projects set up.

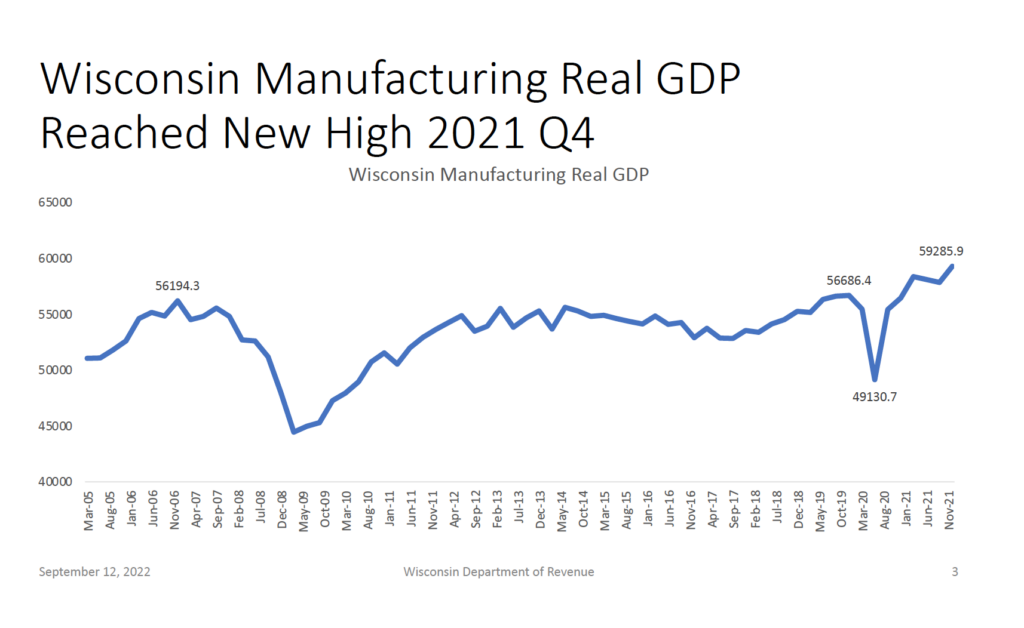

DOR Chief Economist John Koskinen dived deeper into the Wisconsin Manufacturing economy. He discussed how Wisconsin Manufacturing was experiencing a 13 year recovery from the great recession of 2008 and had returned to near peak production levels only hit to the major economic disruption caused by the COVID-19 Pandemic.

Koskinen noted, “You lived through the worst economic contraction in U.S. History. Even if you go back to the great depression, you never had a quarter like you had in second quarter of 2020. Real GDP fell by over 30% in a single period and unemployment hit an all-time high in a matter of 2 months.”

Koskinen said that given that the economy was unwinding and collapsing like something nobody had seen before, “we were in a position where we would try anything.”

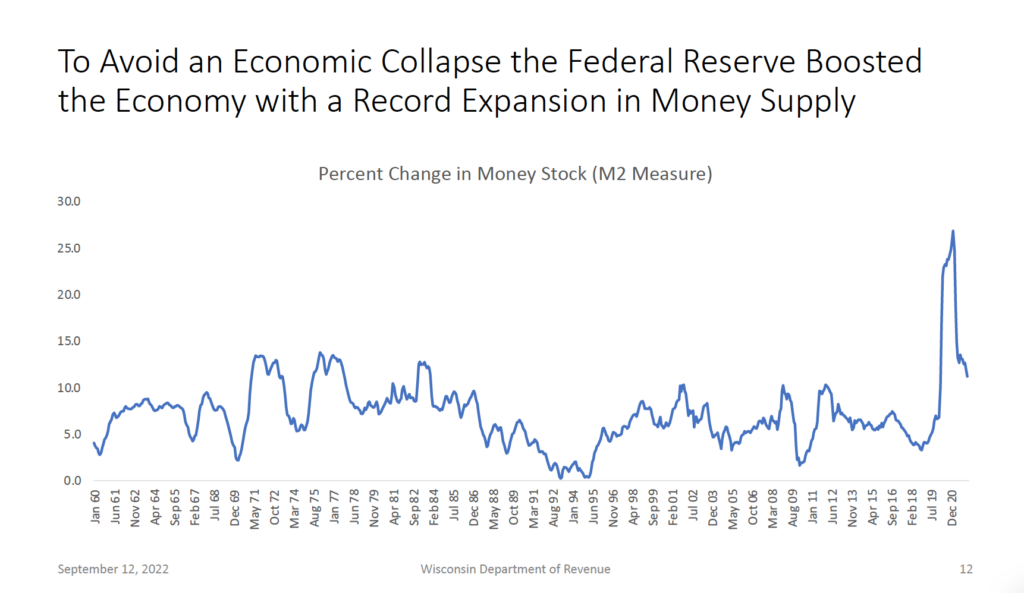

The federal reserve responded by providing the largest increase in money supply in US economic history to try to avoid an economic collapse.

And three rounds of stimulus enacted by the Government helped keep the economy up and running. He noted, that there was initially a huge economic drop but because of the stimulus we didn’t see the full impact of this.

The Manufacturing Industry is staying positive. If there is anything constraining manufacturing right now, it is parts and labor.”

John Koskinen, Chief Economist for the Wisconsin Department of Revenue

Koskinen shared that the stimulus actually lifted WI personal income, which would have gone down substantially without it. He also observed that one of the more impressive aspects was how small businesses were supported and able to stay afloat through the effects of this unparalleled economic shock. Consequently the contractions was the shortest in economic history.

Koskinen then pivoted to the question of whether the US Economy is in or is heading into a recession.

Koskinen explained that National Bureau of Economic Research determines when the US economy is in a recession. He said they track six things: real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production.

Koskinen said that in all six of these measures we are not currently in a recession.

Koskinen then turned his focus to Manufacturing and Industry. He said, “The Manufacturing Industry is staying positive. If there is anything constraining manufacturing right now, it is parts and labor.”

He said manufacturing orders are still running high, and that they reached their record high in June 2022. He noted that durable goods orders are up more than 10% year to date, and that all sectors are experiencing increases in new orders year to date.

Of particular significance he said, the backlog of unfilled orders is actually increasing, which provides some measure of protection against a downturn for manufacturers.

He did note however that while total manufacturing sales were in record territory, that net income, while still relatively high, was starting to decline. He said this was attributable to cost increases eating into margins. He noted two industries, construction and new cars and trucks where costs climbed 17% higher year over year. He said both of those increases were at 50 year high levels.

As a result, manufacturing is seeing strong annual price increases, frequently over 10%.

He noted that with these high cost increases, investment in manufacturing structures is starting to go down, but that equipment replacement and automation spending is still going up, making manufacturing more productive.

Of little surprise to anyone, he said that the labor market continues to be “really tight”. He shared that total US job openings exceeds 10 million since June 2021. For US Manufacturing job openings have been running at 800,000 (nearly double prior levels). In Wisconsin this translates to between 8,000 to 10,000 manufacturing job openings at any point in time.

He shared that currently there are over 218,000 job openings in Wisconsin, and there is a gap of over 126,000 more jobs than we have people to fill them. He said that right now in Wisconsin the number of people receiving unemployment on a continuing basis is at an all-time low.

Given that, he said manufacturing quit rates in the United States are at record highs. He noted as opportunities go up that people will job shop and wages will increase. He shared that annual wage increase, 5.7%, are at the highest level in over 21 years.

Koskinen noted that US economic outlook does include lower growth, higher prices and higher interest rates. Consequently the US economic growth outlook is downshifting from very rapid growth to more sustainable growth. He said, that “We are not anticipating any decline in Industrial Production, but rather just a slowing in the rate of growth.”

He believes that the backlog of unfilled orders (some are out 50 weeks or more) and the overall labor market tightness will provide safety valves that protect against recessions. Given the overall favorable indicators in Wisconsin, and how the state has bounced back from economic disruptions, Koskinen is expecting Wisconsin growth to continue, but at more sustainable levels.

The slides from the presentation have been uploaded and are available for your review.